Rumored Buzz on San Diego Home Insurance

Rumored Buzz on San Diego Home Insurance

Blog Article

Safeguard Your Home and Loved Ones With Affordable Home Insurance Plans

In an uncertain globe where unexpected occasions can interfere with the solemnity of our homes and the safety and security of our loved ones, having a reputable home insurance policy plan in place is vital. By untangling the details of home insurance coverage strategies and exploring practical techniques for protecting affordable protection, you can make certain that your home and loved ones are well-protected.

Relevance of Affordable Home Insurance Coverage

Safeguarding budget-friendly home insurance is crucial for guarding one's residential property and monetary well-being. Home insurance policy supplies security versus different risks such as fire, burglary, all-natural disasters, and individual responsibility. By having an extensive insurance strategy in position, home owners can rest assured that their most significant financial investment is secured in the occasion of unanticipated situations.

Economical home insurance policy not only supplies economic security however additionally supplies satisfaction (San Diego Home Insurance). Despite climbing building values and construction prices, having a cost-efficient insurance coverage makes certain that house owners can quickly restore or fix their homes without facing substantial monetary problems

Moreover, inexpensive home insurance coverage can also cover individual valuables within the home, offering compensation for products damaged or stolen. This protection extends beyond the physical framework of your home, shielding the contents that make a home a home.

Insurance Coverage Options and Limits

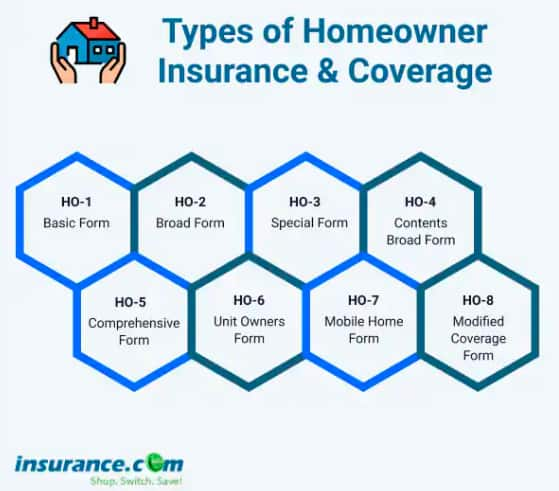

What are the available protection alternatives and limitations for home insurance coverage policies? Home insurance policy policies normally supply numerous coverage alternatives to protect your home and personal belongings. The most typical types of protection include home protection, which safeguards the framework of your home in situation of damage from covered dangers such as fire, windstorms, or vandalism.

When it pertains to coverage restrictions, it's essential to recognize the maximum amount your plan will certainly pay out for each and every sort of protection. These limitations can vary depending upon the plan and insurance provider, so it's important to assess them meticulously to guarantee you have appropriate defense for your home and properties. By understanding the coverage options and limits of your home insurance coverage, you can make informed choices to protect your home and liked ones effectively.

Elements Impacting Insurance Coverage Expenses

Several variables dramatically affect the expenses of home insurance coverage. The location of your home plays a critical function in identifying the insurance costs. Residences in areas susceptible to all-natural catastrophes or with high crime rates usually have greater insurance coverage costs due to boosted risks. The age and problem of your home are also elements that insurance firms consider. Older homes or properties in poor problem might be more expensive to insure as they are more at risk to damage.

In addition, the type of coverage you select directly affects the cost of your insurance coverage plan. Opting for additional protection options such as flooding insurance coverage or quake protection will raise your costs.

Furthermore, why not look here your credit rating, declares history, and the insurance provider you select can all influence the cost of your home insurance policy. By taking into consideration these variables, you can make enlightened choices to aid handle your insurance sets you back successfully.

Comparing Quotes and Carriers

When discovering home insurance policy choices, it is vital to thoroughly compare carriers and quotes to guarantee you discover the most appropriate coverage for your needs and spending plan. Beginning by requesting quotes from several insurance firms. This will give you a clear photo of the different coverage alternatives readily available and the matching prices. When contrasting quotes, think about not only the premium quantity yet additionally the coverage restrictions, deductibles, and any type of fringe benefits supplied.

In addition to contrasting quotes, it is vital to examine the online reputation and financial security of the insurance carriers. Look for customer testimonials, rankings from independent companies, and any history of issues or regulative activities. A trustworthy insurance coverage service provider ought to have a great performance history of promptly processing insurance claims and giving superb customer care.

Moreover, take into consideration the certain coverage features offered by each company. Some insurance companies may provide additional benefits such as identification theft defense, devices break down coverage, or insurance coverage for high-value products. By very carefully comparing quotes and companies, you can make an informed decision and select the home insurance policy plan that best meets your needs.

Tips for Conserving on Home Insurance

After completely contrasting service providers and quotes to find one of the most suitable coverage for your needs and budget plan, it is sensible to discover reliable strategies for saving money on home insurance policy. One of the most significant ways to reduce home insurance coverage is by bundling your plans. Several insurer use discounts if you buy multiple plans from them, such as integrating your home and car insurance policy. Raising your home's security steps can additionally lead to financial savings. Setting up protection systems, smoke detectors, deadbolts, or a lawn sprinkler can minimize the danger of damages or theft, possibly reducing your insurance coverage costs. Additionally, keeping a great credit history can positively impact your home insurance rates. Insurance companies usually think about credit rating when determining costs, so paying bills in a timely manner and managing your credit scores properly can cause lower insurance coverage costs. Finally, frequently assessing and updating your policy to show any type of modifications in your house or circumstances can ensure you are not spending for insurance coverage you no more requirement, helping you save cash on your home insurance coverage premiums.

Verdict

To conclude, securing your home and liked ones with economical home insurance is critical. Understanding protection aspects, limitations, and choices influencing insurance expenses can assist you make notified decisions. By comparing quotes and service providers, you can find the best plan that fits your requirements and budget plan. Applying tips for saving on home insurance coverage can additionally assist you protect the required defense for your home without damaging the bank.

By unwinding the complexities of home insurance strategies and exploring practical techniques for protecting budget-friendly coverage, see this you can make certain that your home and liked ones are well-protected.

Home insurance coverage plans normally offer a number of coverage options to shield your home and possessions - San Diego Home Insurance. By comprehending the protection alternatives and limits of your home insurance policy, you can make enlightened decisions to you can try here guard your home and enjoyed ones successfully

Routinely assessing and upgrading your policy to reflect any kind of changes in your home or conditions can guarantee you are not paying for coverage you no longer requirement, helping you conserve cash on your home insurance coverage premiums.

In conclusion, safeguarding your home and loved ones with budget-friendly home insurance coverage is essential. Report this page