San Diego Home Insurance Things To Know Before You Get This

San Diego Home Insurance Things To Know Before You Get This

Blog Article

Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Policy Plans

Value of Affordable Home Insurance Coverage

Safeguarding budget friendly home insurance policy is critical for safeguarding one's home and financial well-being. Home insurance coverage offers protection against numerous dangers such as fire, theft, all-natural catastrophes, and personal liability. By having a thorough insurance policy plan in position, homeowners can rest ensured that their most significant investment is safeguarded in case of unforeseen situations.

Inexpensive home insurance policy not only provides financial safety and security yet additionally supplies assurance (San Diego Home Insurance). Despite climbing building values and building and construction prices, having a cost-efficient insurance plan makes certain that house owners can conveniently reconstruct or fix their homes without dealing with significant economic worries

In addition, inexpensive home insurance coverage can also cover individual items within the home, offering repayment for things harmed or swiped. This insurance coverage extends beyond the physical structure of your home, protecting the contents that make a residence a home.

Insurance Coverage Options and Limits

When it comes to protection restrictions, it's vital to understand the optimum amount your policy will pay out for every kind of coverage. These limitations can differ depending on the policy and insurance company, so it's necessary to evaluate them thoroughly to guarantee you have ample protection for your home and properties. By understanding the coverage options and limitations of your home insurance coverage, you can make educated decisions to guard your home and loved ones properly.

Elements Affecting Insurance Policy Expenses

Several variables considerably influence the expenses of home insurance plans. The location of your home plays an essential duty in figuring out the insurance coverage premium.

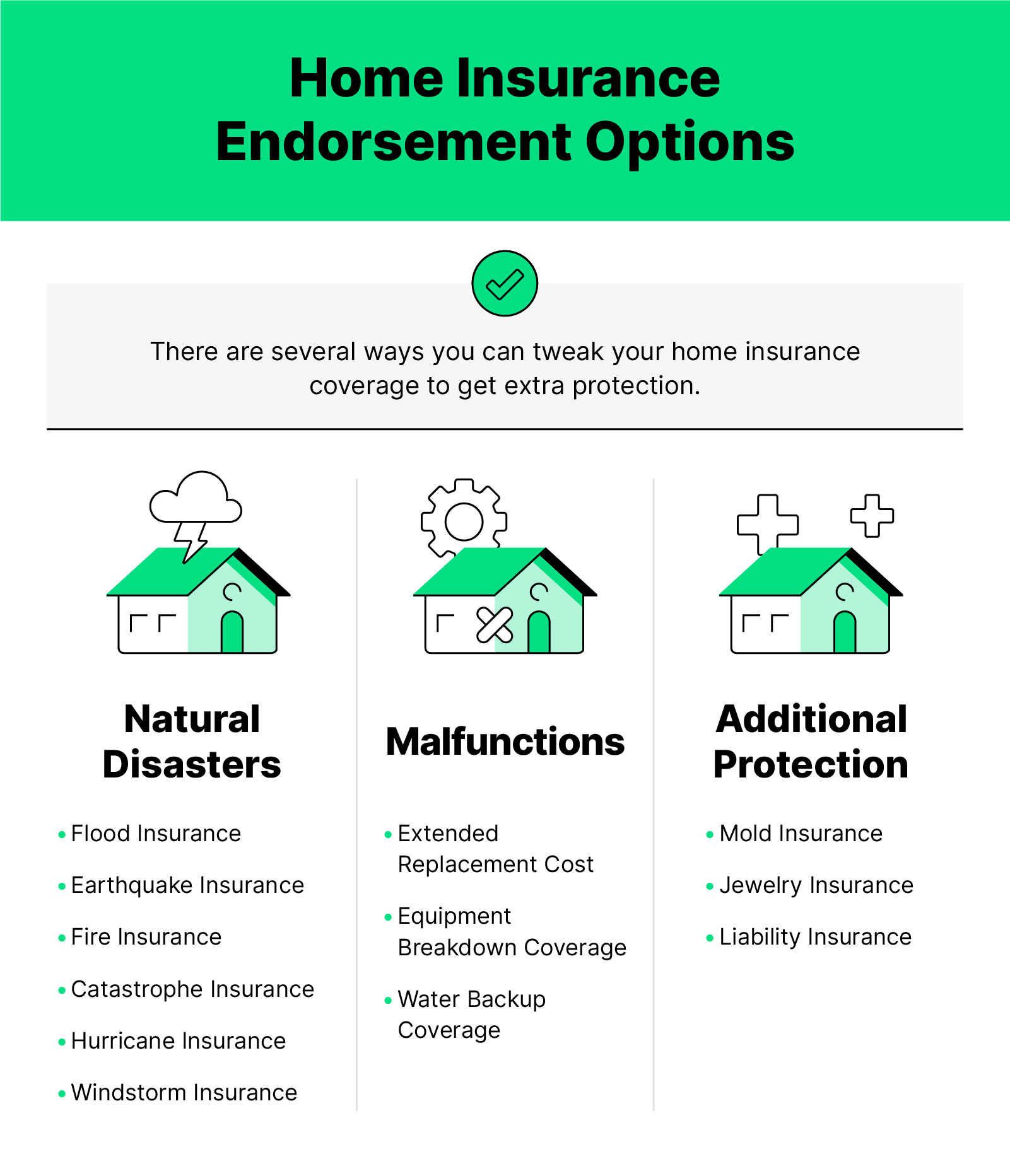

Moreover, the kind of coverage you pick directly affects the expense of your insurance policy. Opting for extra coverage options such as flooding insurance or earthquake protection will enhance your premium.

Furthermore, your credit rating, declares history, and the insurance provider you pick can all influence the rate of your home insurance plan. By considering these factors, you can make enlightened choices to aid handle your insurance coverage costs efficiently.

Comparing Providers and quotes

Along with comparing quotes, it is vital to evaluate the track record and economic stability of the insurance suppliers. Try to find customer evaluations, helpful resources ratings from independent companies, and any type of history of problems or governing activities. A dependable insurance supplier ought to have a good track record of promptly processing claims and offering superb consumer solution.

Moreover, think about the specific insurance coverage functions offered by each copyright. Some insurance firms might provide added advantages such as identity burglary protection, tools break down coverage, or insurance coverage for high-value items. By carefully contrasting quotes and service providers, you can make a notified decision and select the home insurance policy strategy that finest meets your needs.

Tips for Saving Money On Home Insurance Coverage

After thoroughly contrasting quotes and companies to locate one of the most suitable insurance coverage for your demands and budget plan, it is prudent to explore reliable methods for saving on home insurance policy. Among the most substantial methods to save money on home insurance policy is by packing your plans. Lots of insurer offer price cuts if you buy numerous plans from them, such as integrating your home and auto insurance coverage. Enhancing your home's safety procedures can also bring about financial savings. Installing safety systems, smoke detectors, deadbolts, or an automatic sprinkler can decrease the threat of damage or burglary, potentially decreasing your insurance premiums. Additionally, keeping a good credit history can positively impact your home insurance rates. Insurers commonly think about credit report when figuring out costs, so paying expenses on time and managing your credit report sensibly can result in lower insurance policy expenses. Regularly reviewing and updating your plan to reflect any type of changes in your home or circumstances can guarantee you are not paying for protection you no longer requirement, helping you save cash on your home insurance policy premiums.

Verdict

To conclude, guarding your home and loved ones with budget-friendly home insurance policy is critical. Comprehending coverage restrictions, aspects, and choices influencing insurance coverage expenses can aid you make notified decisions. By comparing quotes and providers, you can locate the most effective plan that Going Here fits your demands and budget. Applying ideas for minimizing home insurance policy can also help you protect the required security for your home without breaking the financial institution.

By deciphering the details of home insurance coverage plans and discovering sensible strategies for protecting budget-friendly protection, you can make certain that your home and loved ones are well-protected.

Home insurance coverage plans typically supply several insurance coverage alternatives to secure your home and items - San Diego Home Insurance. By comprehending the protection options and restrictions of your home insurance coverage policy, you can make enlightened decisions to safeguard your home and liked ones efficiently

Routinely reviewing and upgrading your policy to mirror any type of changes in your home or conditions can guarantee you are not paying for protection you no longer requirement, aiding you conserve cash on your home insurance coverage premiums.

In final thought, protecting your home and loved ones with budget-friendly home insurance coverage is critical.

Report this page